Global accounting firm KPMG placed Australia among the top ten most competitive locations for R&D investment.

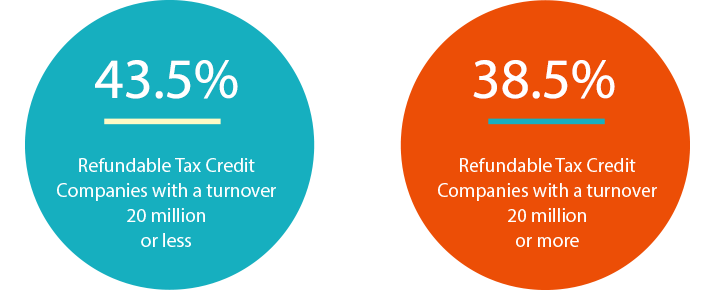

The R&D Tax Incentive is specially designed to make access to Australian R&D tax benefits more efficient and more predictable. The Australian Government’s R&D Tax Incentive gives companies with an annual aggregated turnover of less than A$20 million a 43.5 per cent refundable tax credit, and companies with an annual aggregated turnover of more than A$20 million a 38.5 per cent non-refundable tax credit on eligible Australian R&D expenditure.

Unlike similar programmes in other countries, there is no requirement for companies in Australia to demonstrate year-on-year growth in their R&D expenditure in order to claim an R&D tax rebate in Australia. There is also no requirement for intellectual property from eligible R&D projects to be held in Australia. This recognises the inherent value of the research and development process itself, notwithstanding the eventual “location” of the resulting intellectual property ownership.

Which clinical trials are eligible for the Australian R&D Tax Incentive?

A clinical trial must meet the definition of a ‘core’ or ‘supporting’ R&D activity under Australian law to be eligible for the Australian R&D tax incentive. An eligible claim must have at least one ‘core’ R&D activity, which must be an experimental activity that meets certain criteria.

In general, while there are some exclusions activities conducted in early stage development or clinical trials (Phase 0/I, II and III) undertaken in Australia are likely to meet the criteria for the Australian R&D tax incentive. Phase IV clinical trials are not eligible as core R&D activities if they are being carried out to meet regulatory requirements. However, where they are being carried out as experiments for the purpose of resolving further medical research studies, and eligibility requirements are met, Phase IV clinical trials may be eligible.

People who read this were also interested in:

> Benefit from Australia’s rapid clinical trials approval system

> How is valuable intellectual property protected in Australian clinical research studies?